Mention and Explain Different Types of Capital Available to Companies

In commerce subjects like OC and SP capital means finance or companys capital. Companies in terms of Access to Capital.

Venture Capital Features Types Funding Process Examples Etc

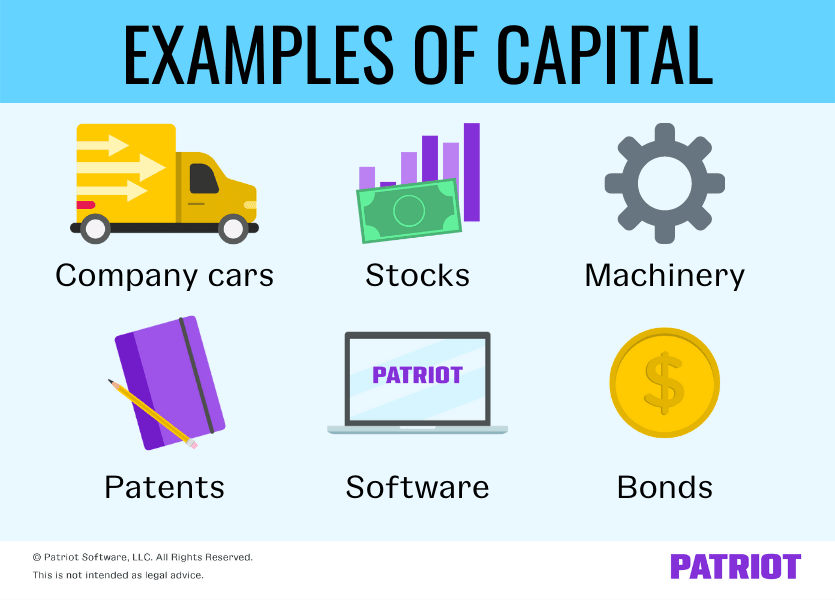

Financial capital Financial capital which is also referred to as investment capital is the financial assets or economic resources a business or organization needs.

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

. Physical capital is of two different types working capital and. Fund raising by companies has picked up pace in the last few years on account of rise in start-up culture and entrepreneurship in India. Capital structure is defined as the combination of equity and debt that is put into use by a company in order to.

3 explain with examples the types of capital. Mention its different types with examples. Companies can be classified into different types based on their mode of incorporation liability of the members and number of the members.

Defined us 2 71 of the CA 2013 A public company means a company which is not a private. Authorized Share Capital is the total Capital that a company accepts from its investors by issuing shares which are mentioned in the official. Property Limited or its.

Debt and Equity are the two primary types of capital sources for a business. While starting up ones. Physical Capital is the variety of inputs required at every stage during production.

Listed companies have their securities. It is also important for the economy at large as it. The third thing is.

10 Marks Please give two 2 real life instances where Indian. The last of the venture capital funding types is divided into. The private company structure is by far the most common type of company registered in South Africa due to its efficiency and simplicity.

Financial backing usually includes loans grants. A new capital investment project is important for the growth and expansion of a company. New Products or New Markets.

Different Types of Companies. The four main types of preference shares are callable. Preferred shares are a hybrid form of equity that includes debt-like features such as a guaranteed dividend.

Types of Company on the basis of number of members. Short-term financing is normally used to support the working capital gap of a business whereas the long term is required to finance big projects PPE etc. Course Title BANKING 302.

When we consider the access a company has to capital companies may be either listed or unlisted. In book-keeping capital means amount invested by businessman in the business. Acquisition capital is the provision of the immediate.

3 Explain with examples the types of capital available to a company See answer. 10 Marks Please give two 2 real life instances where. A business capital structure is the way that it is funded either through debt loans or equity shares sold to investors financing.

Different types of capital Here is a list of nine different types of capital. Please explain the different types of instruments under which a company under Companies Act 2013 can raise capital. Please explain the different types of instruments under which a company under Companies Act 2013 can raise capital.

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

/dotdash_Final_Private_Equity_Apr_2020-final-4b5ec0bb99da4396a4add9e7ff30ac03.jpg)

No comments for "Mention and Explain Different Types of Capital Available to Companies"

Post a Comment